image credits: eremedia.com

(To understand about my millionaire mentor, read here first. I use ‘MM’ as an acronym to Millionaire Mentor. The lessons can be read randomly i.e. need not follow chronological order.)

MM practices good habits that shapes his attitude towards money & financial literacy today.

Watch your thoughts, for they become words.

Watch your words, for they become actions.

Watch your actions, for they become habits.

Watch your habits, for they become your character.

And watch your character, for it becomes your destiny.—Lao Tsu

To create your desired destiny, we start with our thoughts & cultivate good habits. MM’s daily habits are simple, & if you’re willing, it is easily replicable into your daily routine.

Habit 1: Read, read & read

MM loves reading, especially on finance & investment. The first step MM took on his financial independence journey, was to educate himself. One of the best (& economical) way was to read. MM would borrow books from the library, as well as read extensively through financial blog articles written by fellow financial bloggers, both in local Singapore context & overseas.

While some may choose to entertain themselves by playing mobile phone games or social media consumption during their free time, MM instead, would spend that time reading online financial & investment articles. Even during snippets of free time such as on train, or waiting for friend(s), he would read. Knowledge, just like the best things in life, can be free.

One good website to read articles by financial bloggers – thefinance.sg. This website pulls articles from various financial & investment bloggers’ website / blogsite, providing a feed of articles. You can also link to its respective websites / blogsites through the articles & feast on more financial knowledge & advice of other bloggers, some who are very successful garnering >$100K passive income annually, some on the journey towards financial independence. Nonetheless, read with an open mind, always verify the information & advice shared.

MM also follows overseas financial bloggers (some who have retired at ages as young as 30+ with passive income that pays for their expenses, freeing up their time to pursue their passions, without money worries). Some examples are:

- http://www.mrmoneymustache.com

- http://www.financialsamurai.com

- livingafi.com

- http://www.earlyretirementextreme.com

- Retireby40.org

- Rootofgood.com

- Singaporeanstocksinvestor.blogspot.com

Note: Above site listing will be updated as & when MM finds new & good sites to learn more from.

Knowledge can be free. Start reading today!

Habit 2: DFS (Discipline, Frugality, Simplicity)

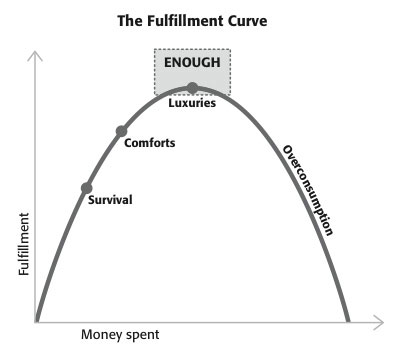

MM practices DFS – Discipline, Frugality, Simplicity. MM is very disciplined especially when it comes to money & money management, is frugal & lives simply. MM has reached the point in the fulfillment curve, knowing when is enough.

Credits: getrichslowly.org

I’ll leave the sharing about MM’s discipline, frugality & simplicity in another post.

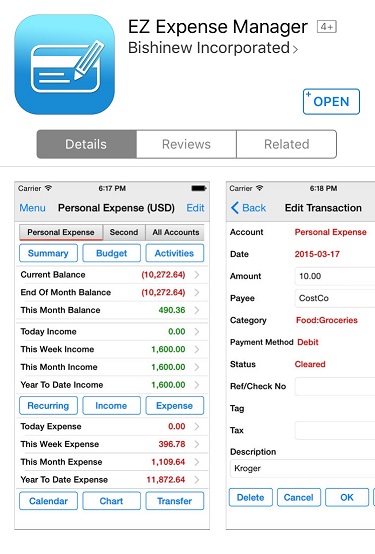

Habit 3: Record all expenses

image credits: ibear.com

MM records ALL expenditures in a mobile app (iBear Money). I started this habit only in year 2014, & I can tell you my only regret is not starting earlier. I used to find this a hassle, pointless & thought MM was kind of a weirdo for doing so – even for a cup of $1 coffee! This was the first habit MM encouraged & insisted I practice. Ironically, I soon realize the beauty of this habit & now strongly advocate you to follow suit too. Here are my reasons why:

1. Self-Awareness

With every single record I input into my expense tracking mobile app, it made me aware of that particular transaction, as compared to simply paying $ and forget after that. Our mind works wonders, especially so when I create a visual image to my subconscious mind by inputting the record that $ was spent.

Through this, I could easily tell the areas where I can reduce my expenses = more savings = bigger ‘war chest’ for investing = more passive income = reach financial independence earlier = less need to work for money = earlier retirement from working for money = FREEDOM! (from slavery to your bosses / having to work for money / run rat race)

2. Shapes spending habits

Try this habit for a month or two, you’d be surprised the little amounts spent on drinks, food, entertainment etc, could add up to quite a significant amount at month end! Because of this, I grew cautious of my spending. This helped to change & shape my money spending habits.

3. Mental math

Ever since I developed this habit, before spending any single dollar, I subconsciously did a mental calculation whether it is a necessary spend & whether it is value for money. I end up spending less & save more money.

4. Controls spending

When I notice that my expenses for the month is reaching my budget limit, I could control my spending for the rest of the month. Very helpful in preventing overspending. At one glance, I know what I spend on & how much was spent. At the power of a few tabs on my mobile, I could see whether I had overspent, what was my biggest expense component, etc. Even previous years’ expenses! Without recording, do you even know how much you really spend, what you spent on? I used to think I ‘roughly’ know & I am not spending much. Until my first full month of recording, I got a big shock, because my perceived small amounts of spending, ended up an amount much bigger than I thought!

5. 1st action to take towards financial freedom

If you do realize the beauty of recording expense, it is the 1st step to money management & a good step towards achieving financial freedom!

Habit 4: Set budgets

MM sets a monthly budget for different areas of expenditure & sticks to it. In the event the spending for a component (e.g. food) exceeds MM’s budgeted amount, MM will use other component’s (e.g. entertainment) budget to cover (i.e. entertainment’s budget will get reduced). MM can get pretty disciplined to spend within the budget. Of course, there are occasions when budget were exceeded due to unforeseen circumstances, which MM will try to reduce spending the next month to cover.

MM has a very interesting budget component called ‘Play jar’. MM sets aside X dollars monthly into ‘Play jar’, of which any unspent dollars at each month end accumulate towards the end of the year & will be fully utilized. MM utilizes ‘Play jar’ money for the purpose of having fun, treating friends to meals, gifts, or simply for the purpose of creating value, happiness & enjoyment in life for loved ones & more.

Habits really do determine your destiny

What have you done today to make a better tomorrow? I personally suggest 5 actions you can take now:

1. Set aside 30 minutes to read daily

Are you spending your free time chasing the latest drama show, playing games, or educating yourself through reading, that gives you the knowledge & power to improve your current lot? 5 years on, are you still chasing the next drama show, playing the next latest game, catching more Pokemons, or is better educated & have taken actions that propels you further? A little step a day goes a long way overtime. Set aside 30 minutes a day to read, 1 year on, you would have spent 182.5 hours educating yourself!

2. Record all your expenses

I shared the beauty of doing so above, what’s stopping you?! The funny thing is, many will still not do it, because the inertia to start the habit is great, just as it did for me. Give yourself this challenge to keep up for 1 month, you might be surprised at month end of your expense report =) Keep going for 2nd & 3rd month, don’t give up!

This is how I do it:

I use this free expense tracker app on my smartphone: Expense Manager (by Bishinew Incorporated / Bishinews)

iPhone users can download Expense Manager here

Android users can download Expense Manager here

Screenshot of Expense Manager App on iTunes

Note: This app is my personal preference. There are many other Expense tracker apps on iTunes & Google Play. Do explore & use any one that you like.

I record my daily expenses during pockets of free time. E.g. while queuing, while waiting for food to be served, while in toilet (don’t judge me), while in lift, while waiting for friends, etc. And it takes me only a few seconds to record each expense transaction. You do have a few seconds a day right?

3. Simplify your life

Do you notice when one earns more, one tends to spend more too? Remember the time when you first started working, you were probably spending your money on repaying education loan, basic work clothes, shoes, bags, entertainment, dining in restaurants.

After a few years, with higher salary, you moved on to buy more premium clothes, more shoes, luxury bags, watches, travels to further places, expensive insurance plans, gym membership, more expensive restaurants, starting to eye on a car, or perhaps upgrade your old car to a bigger one & maybe that beautiful condominium?

Do you see the pattern here? As you earn more, you tend to want to spend more. Our society has been ‘programmed’ since young by the media & economy, to consume. Don’t fall into this vicious cycle.

MM always tells me, financial independence can be achieved very simply: Earn more, invest more, save more, spend less. MM also says: Earn like an adult, spend like a student.

We have a pair of legs, 30 days a month. Do you really need 50 pairs of shoes? Are you a caterpillar?

Kids have a pair of eyes & a pair of hands. Do they really need 30 toys?

The sale is on! Your favorite brand of polo-tee is on sale at 2 for $100 instead of the usual $70 each. Wow that’s more than 25% discount, & $40 ‘savings’! And so you bought the 2 polo-tees. My friend, you just spent $100, not saved $40. And now you probably have 50 polo-tees?

4. Set a monthly budget & stick to it

There’s a few ways to go about this, depending on how detailed you want. MM has budget for different aspects (e.g. food, insurance, utilities, play jar, entertainment, etc).

As for me, I set a total monthly expenditure budget, as well as for specific aspects, e.g. household groceries. As I record each expense transaction, it becomes nearer to the budgeted amount, & I spend cautiously especially when it is inching near to the limit. If I overspend in the current month, I’ll cut down my expenses in the next month.

The amount for expenditure budget should of course be lesser than your savings amount. The lesser the expense budget, the more you save, the earlier you enjoy financial freedom. For example, assuming your take home pay is $5K monthly (after deducting CPF contribution), $2.5K expense budget allows you to save 50%, $2k expense budget allows you to save 60% of your take home pay.

5. Why are you doing this?

When we have a purpose, our actions follow. Starting new habits require discipline, patience & repeated actions to become a natural daily task. Just like learning to brush our teeth. We do it every single day from young. If you skip brushing your teeth once, it probably feels weird.

I hope you start cultivating the good habits from today on =)

Hi Happy Money Happy Life,

Totally agree with you. The more we save, and the less we try to look rich, the faster we can achieve early retirement. I personally use this app for recording my expenses, and I think it is simple to easy and quick. Cash flow free: https://itunes.apple.com/sg/app/cashflow-free/id294304828?mt=8

lazysingaporean.blogspot.com

LikeLike

Hi lazy singaporean, thanks for sharing. I’ll check it out

LikeLike

Hello,

Just finished all of your blog posts and they made me want to start reading, working, saving and ultimately, investing. However, I will be enlisting in October and do you think I will have to postpone these plans? I know I can start reading now to form a habit but do you think those knowledge will become obsolete by the time I finished my National Service?

LikeLike

Hi darren, glad that my posts somehow inspired you to start your journey 🙂

Let me give you another perspective.. Imagine you are going to a non-English speaking country for 2 years. Would you then stop using English altogether? Or would English become obsolete after 2 years?

Financial literacy is just like a language, a lifeskill. Whatever you learn about financial literacy will stay with you forever & never become obsolete. It will only get better over time. Just like a language e.g English. It gets better when we read more & use it more often.

In fact, at your age, it is the best time to read & educate yourself. You have the advantage of time & you probably have an empty cup that you can fill with all the new knowledge. It is much better than one who has the wrong mindset & needs to empty their cup before filling it with new knowledge.

MM taught me: Before one can climb mount everest, or maybe a lower mountain, mount Kinabalu, one has to go through rounds & rounds of training, body conditioning etc, before they even start scaling. This is the same for your financial journey. You need to train, condition your mind, practice, before you start scaling the actual mountain.

And the best time to do it? 10 years ago. The next best time? Now.

Cheers 🙂

LikeLike